Enhancing Property Insights for Insurers

Risk Mitigation and Cost Reduction

Planna is a cutting-edge tool for monitoring and managing housing stock. Using AI, it identifies potential issues early, reducing the likelihood of costly claims by up to 30%. By promoting proactive maintenance, Planna helps extend property lifespans and minimise asset depreciation, reducing long-term risks associated with neglect.

Data-Driven Risk Assessments

Planna includes a suggested Preventative Maintenance Budget (PMB), based on a property's assets and condition and creates projected savings or Preventative Cost Advantages (PCA), achievable by completing the tasks generated in the maintenance plan. These metrics help insurers assess and price policies more accurately, while also identifying properties with reduced claims potential due to proactive maintenance.

Streamlined Policyholder Engagement

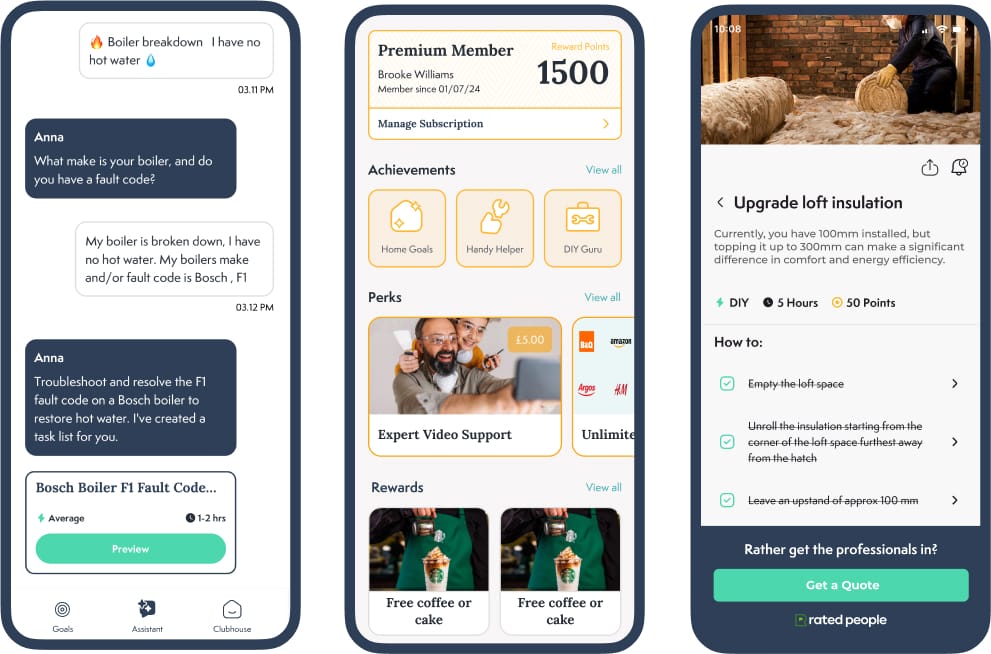

Planna’s innovative reward system incentivises occupants to complete maintenance tasks, ensuring properties are consistently well-maintained. This reduces the frequency and severity of claims, while fostering policyholder engagement and satisfaction.

Targeted Improvement Opportunities

Through in-depth property analysis, Planna identifies improvement opportunities that align with insurers' goals of mitigating risk. These include measures to reduce repair costs, and improve structural integrity, all of which support reduced claim payouts and better portfolio outcomes.

Features

*Click to expand

AI Lenses

- Our patent-pending AI image analysis identifies property risks and repair issues at the earliest opportunity.

AI powered support

- Property specific AI Agent

- LLM unique to each user

- Product recommendations to assist with task completion.

- Issue triage and responsibility determination

- Create tasks from document uploads

- Q&A complex documents

Rewards & Perks

- Gift cards from leading high street retailers

- In app property and area report

- Discount codes and offers from retailers

- Badge scheme to incentivise behaviour.

Tailored Tasks

- Tasks tailored using AI to each properties features, build type, condition and location

- Flexibility to create tasks that help residents meet their responsibilities under the tenancy agreement.

Key Benefits

Valuable Property Data

- Remotely gain real-time insights into the condition of homes

Cost Savings

- Reduce reactive claims volume and associated costs by up to 30% through preventive measures.

- Reduced volume of call-out charges

- Minimise customer acquisition costs through longer retention.

Improved Customer Experience

- Proactive and positive engagement throughout the entire policy lifecycle.

- 24/hour blended human and AI support.

- Our powerful LLM helps users understand complex policy documents by analysing them to create tasks and providing context for support inquiries.

- Expert video support help reduce repair costs by addressing issues at the first response, minimising the overall expense of repairs.

- Reward or compensate your customers with vouchers from top retailers.

Not Reliant on IOT

- Empowering policy holders to be proactive benefits both parties.

- Cost-effective

- Requires no IoT or hardware

- Easy to adopt.

Drive Behavioural Change

- Foster new habits by encouraging and reinforcing behavioural change with rewards

- Tasks tailored to both the needs of the property and responsibilities under the contract.

- Customer insights, Understand attitudes toward property upkeep and maintenance habits.