An ounce of prevention is worth a pound of cure

Insurance has always been a reactive industry, especially when it comes to home insurance. While sectors like auto and health insurance have made strides towards proactive and preventive models, home insurance remains stuck in a cycle of responding to claims after the damage has already occurred. Car insurance companies now use telematics to reward safer drivers, and health insurers have embraced fitness tracking to encourage healthier lifestyles. Yet home insurance lags far behind, with little emphasis on prevention or engagement.

What’s missing from home insurance is a shift towards a proactive model—one that helps prevent incidents from happening in the first place. Imagine a system that could help homeowners address minor issues before they turn into major, costly claims. This shift towards prevention is already being explored in other areas of our lives, with apps like Biscuits encouraging healthier habits in pets by promoting activities that support their well-being and offering assistance with vet consultations. The same engagement-driven model could benefit the home insurance industry, if done right.

IoT and the False Promise of the Silver Bullet

One of the most hyped solutions to the problem of prevention in home insurance has been the Internet of Things (IoT). Devices such as water leak sensors, smart thermostats, and smoke alarms have been touted as the future of home insurance—offering insurers the ability to track the condition of homes in real time and prevent disasters before they happen.

However, the adoption of IoT in home insurance remains limited, and for good reason. The cost of IoT devices is high, and for many homeowners, particularly those in older or lower-income households, the upfront investment may not be worth it. Additionally, while these devices offer some degree of monitoring, they are not a silver bullet. IoT solutions may help detect certain risks, but they often require consistent maintenance and can still fail to prevent the most common home insurance claims, such as water damage or fire.

Moreover, IoT’s success in other industries, like auto insurance, has not been fully mirrored in home insurance. In cars, telematics can directly track driving behaviour, offering a clear and immediate link between the insured’s actions and their premium. Home environments, however, are more complex. The risks vary widely, and a single IoT device cannot offer a holistic solution. It’s time to question whether IoT alone can solve the underlying issues in home insurance, or if a broader approach to engagement and prevention is needed.

AI Image Analysis: A Powerful Tool for Proactive Home Insurance

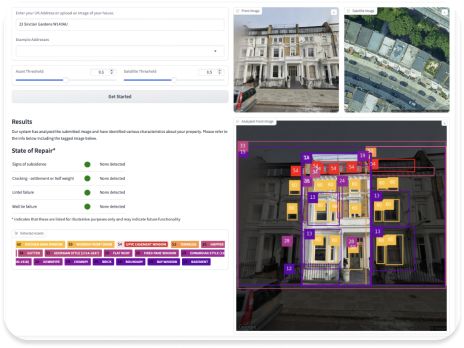

Instead of focusing solely on IoT, insurers should consider the role AI can play in transforming home insurance into a more proactive industry. AI-powered image analysis is one of the most promising technologies in this space. By analysing photos or video footage of a home’s interior and exterior, AI can identify early signs of damage—like mould, cracks in the foundation, or deteriorating roofing materials—long before they turn into major problems.

AI doesn’t require homeowners to install costly devices around their homes. Instead, simple images taken by the homeowner or even drone footage can be fed into AI systems that analyse the condition of a property. This technology enables insurers to assess risk more accurately and provide tailored advice to homeowners, offering suggestions for maintenance and repairs that could prevent future claims.

At Planna, we are already harnessing the potential of AI to help homeowners maintain their properties. Planna encourages users to complete preventive tasks around the home, such as checking for leaks or mould, and rewards them for doing so. In this way, Planna fosters a culture of proactive maintenance that benefits both the homeowner and, by extension, any potential insurers. It’s easy to see how this approach could be scaled to help insurance companies shift towards prevention, reducing the number of costly claims by tackling the root cause of many common home issues.

A Shift Towards Tailored, Preventive Home Insurance

The concept of blanket insurance policies that treat every home and every homeowner the same is increasingly outdated. Each property is unique in its construction, location, and the habits of its owners, yet the current insurance model fails to account for these differences. Homeowners who take proactive measures to maintain their properties are often left with the same premiums as those who neglect their homes, simply because the system does not reward preventive behaviour.

We believe there is a huge opportunity to create a home insurance product tailored to each property. By leveraging AI and data-driven insights, insurers could offer policies that reflect the actual condition of a home, rewarding homeowners who take care of their properties and helping those at higher risk mitigate potential issues before they arise. Rather than waiting for the next burst pipe or electrical fire, this new model would focus on engagement and prevention, driving down costs for insurers and making home insurance more dynamic and responsive to the needs of homeowners.

Conclusion

The home insurance industry is at a crossroads. While IoT has been widely touted as the future, its limitations—both in terms of cost and efficacy—suggest it is not the comprehensive solution insurers hoped for. Instead, the focus should be on a broader shift towards prevention, driven by technologies like AI image analysis. By moving beyond reactive claims processes and embracing proactive engagement with homeowners, the industry has the potential to reduce costs and offer more personalised, meaningful coverage.

The future of home insurance doesn’t lie in one-size-fits-all policies, but in tailored, preventive approaches that reflect the unique risks of each home. This shift will not only benefit insurers but also empower homeowners to take better care of their properties, creating a win-win scenario for all parties involved.