And why are so many people talking about them?

More than half of people in the UK are receptive to the concept of a green mortgage, with close to two-thirds saying they would consider taking one out. But what exactly is a green mortgage and why are they becoming increasingly important?

An expanding number of banks and building societies across the UK now offer green mortgage products. These are designed to support more energy-efficient homes and help homeowners reduce both costs and environmental impact. Below, we explore what qualifies a mortgage as green and how these products contribute to improving the UK’s housing stock.

What is a green mortgage?

A green mortgage is not a loan funded by environmentally focused investments, nor does it necessarily involve profits being directed towards renewable energy projects.

Instead, the defining feature of a green mortgage is its connection to a property’s energy efficiency. These products typically fall into three main categories:

- Preferential interest rates for homes with strong energy efficiency ratings.

- Access to additional funds - via cashback, discounted rates, or credit, to pay for energy-saving upgrades to an existing property.

- Increased borrowing options when remortgaging or purchasing a home that requires energy efficiency improvements.

All three approaches aim to reduce household carbon emissions while helping homeowners offset upfront costs through lower energy bills. A higher Energy Performance Certificate (EPC) rating may also enhance a property’s market value, as it signals lower long-term running costs.

Why are green mortgages needed?

The UK has committed to the Paris Agreement target of limiting global warming to 1.5°C and has set a goal of achieving net zero emissions by 2050 (2045 in Scotland). Improving the energy efficiency of the nation’s housing stock is essential to meeting these targets.

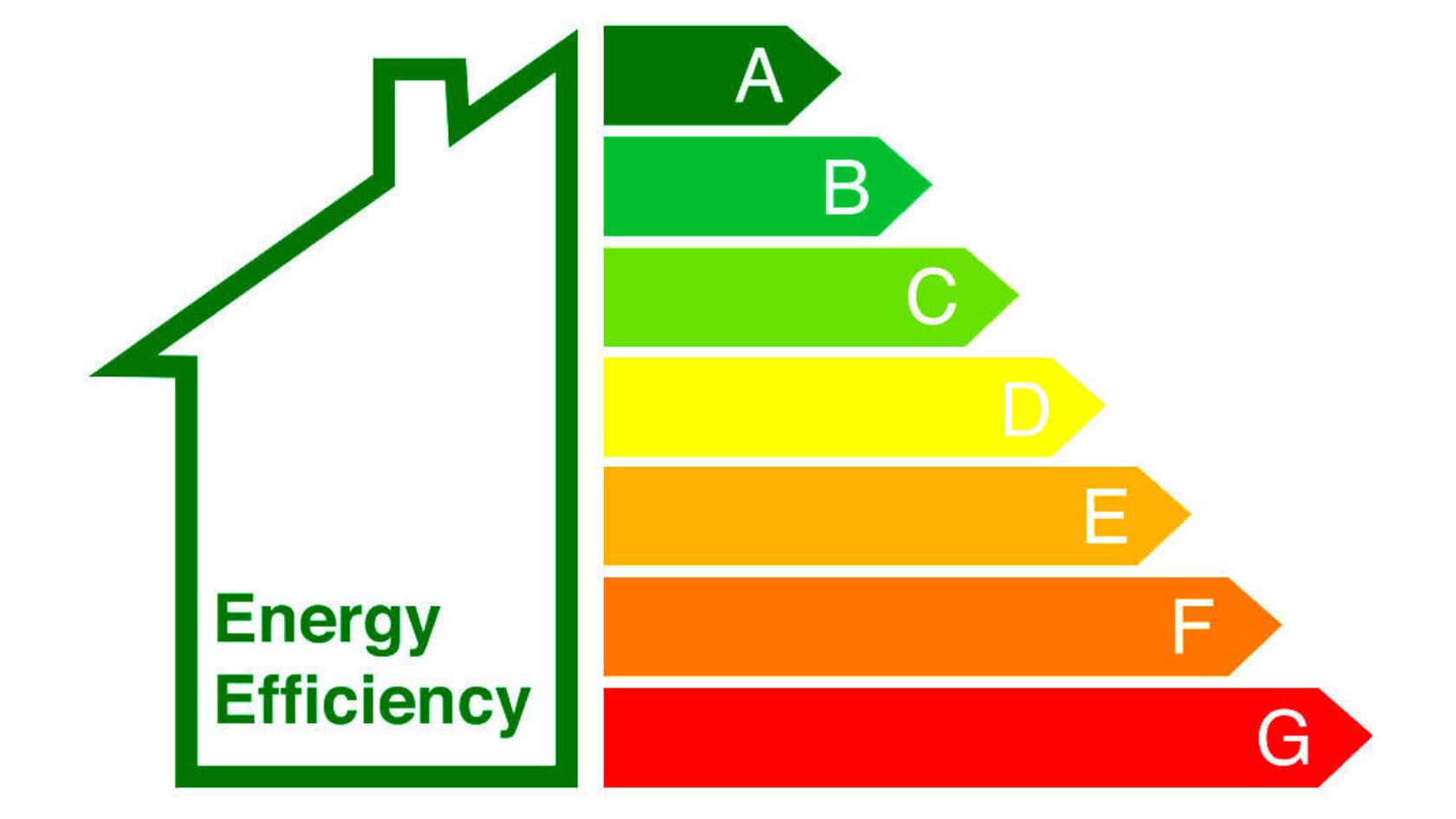

According to the Office for National Statistics, the UK had approximately 27.8 million households in 2020, spread across England, Scotland, Wales and Northern Ireland. All homes must have a valid EPC when sold or rented, with ratings ranging from A (most energy efficient) to G (least efficient). While newer properties typically achieve A or B ratings, older homes—particularly historic buildings—often perform significantly worse.

The UK Government has set a target for all homes to reach at least an EPC rating of C by 2035. However, only around 3% of homes currently achieve an A or B rating, and approximately 68% fall below the recommended C level.

The Climate Change Committee estimates that £250 billion will be required to upgrade UK homes by 2050. Given that the UK has Europe’s largest mortgage market—with over £233 billion lent in 2016 alone—green mortgages represent a practical way to channel funding into energy efficiency improvements.

How do green mortgages work?

Lenders assess household expenditure, including energy costs, when determining mortgage affordability. Traditionally, energy bills are assumed to account for around 4.4% of household spending, which can mask significant differences between inefficient and efficient homes.

For example, a family living in a poorly rated ‘G’ property may spend around £200 per month on energy, compared with closer to £50 in a highly efficient ‘A’-rated home. Green mortgages factor in these differences, recognising that lower energy costs can increase a household’s capacity to meet mortgage repayments.

As a result, buyers of highly efficient homes may be able to borrow more. Research suggests that improving a property by two EPC bands could unlock up to £4,000 in additional borrowing, driven by reduced monthly energy bills.

To incentivise upgrades, lenders may offer lower interest rates, additional borrowing, or cash-back, sometimes released only once improvement works are completed. In some cases, lenders require a defined portion of funds to be spent on approved energy efficiency measures or for the property to reach a specified EPC rating.

How can homeowners improve an EPC rating?

Older homes, particularly those built over 100 years ago, typically incur higher energy costs. While many properties can benefit from standard upgrades, each home requires a tailored approach.

Improvements may include better insulation, installing a heat pump, or making simple behavioural changes. It’s important to follow expert guidance and implement measures in the correct order to achieve the best results.

What are the benefits of improving an EPC rating?

Green mortgages do not usually include advice on which upgrades to install, so it’s vital that improvements are appropriate for the property. For example, heat pumps perform best in well-insulated homes.

Raising a property’s EPC rating can deliver multiple benefits, including:

- Lower household energy bills.

- Reduced environmental impact.

- Access to preferential mortgage rates.

- Increased property resale value.

- Higher potential borrowing limits.

Private landlords must also meet minimum energy efficiency standards, with rental properties required to achieve at least an EPC rating of E.

Where can I find more information about EPCs?

In Scotland, EPCs can only be issued by organisations approved by the Scottish Government and listed on the Scottish EPC Register. Scotland uses a different assessment framework from the rest of the UK, so care should be taken when comparing ratings. Home Energy Scotland provides guidance on efficiency improvements, grants and support.

In England, Wales and Northern Ireland, EPCs are produced by accredited domestic energy assessors. Registers are available via GOV.UK, alongside further guidance on improving home energy efficiency.

How can I access a green mortgage?

Although still relatively new to the UK market, green mortgages are expected to grow rapidly as awareness increases. Many major lenders including, Lloyds , Halifax and Barclays, as well as other nationwide lenders, already offer green finance products.

With significant investment needed to modernise the UK’s housing stock, green mortgages are likely to become an increasingly important tool in supporting energy-efficient homes and helping the country move closer to its net zero ambitions.