When you think about property, the first things that come to mind are usually location, price, and maybe the size of the kitchen. But in today’s housing market, another factor is becoming just as important: the Energy Performance Certificate (EPC) rating.

Once seen as just another piece of paperwork, EPC ratings are now at the heart of discussions about property values, mortgage lending, and the UK’s journey towards net zero. And it isn’t just policymakers who are driving this change, the major UK mortgage lenders are building green initiatives around EPCs - giving consumers an opportunity to lower their bills or unlock new mortgage incentives, like lower rates for their mortgage.

In this post, we’ll explore what EPC ratings mean for homeowners and landlords, how they fit into the bigger climate agenda, and how financial institutions are shaping the future of housing efficiency.

What Is an EPC Rating?

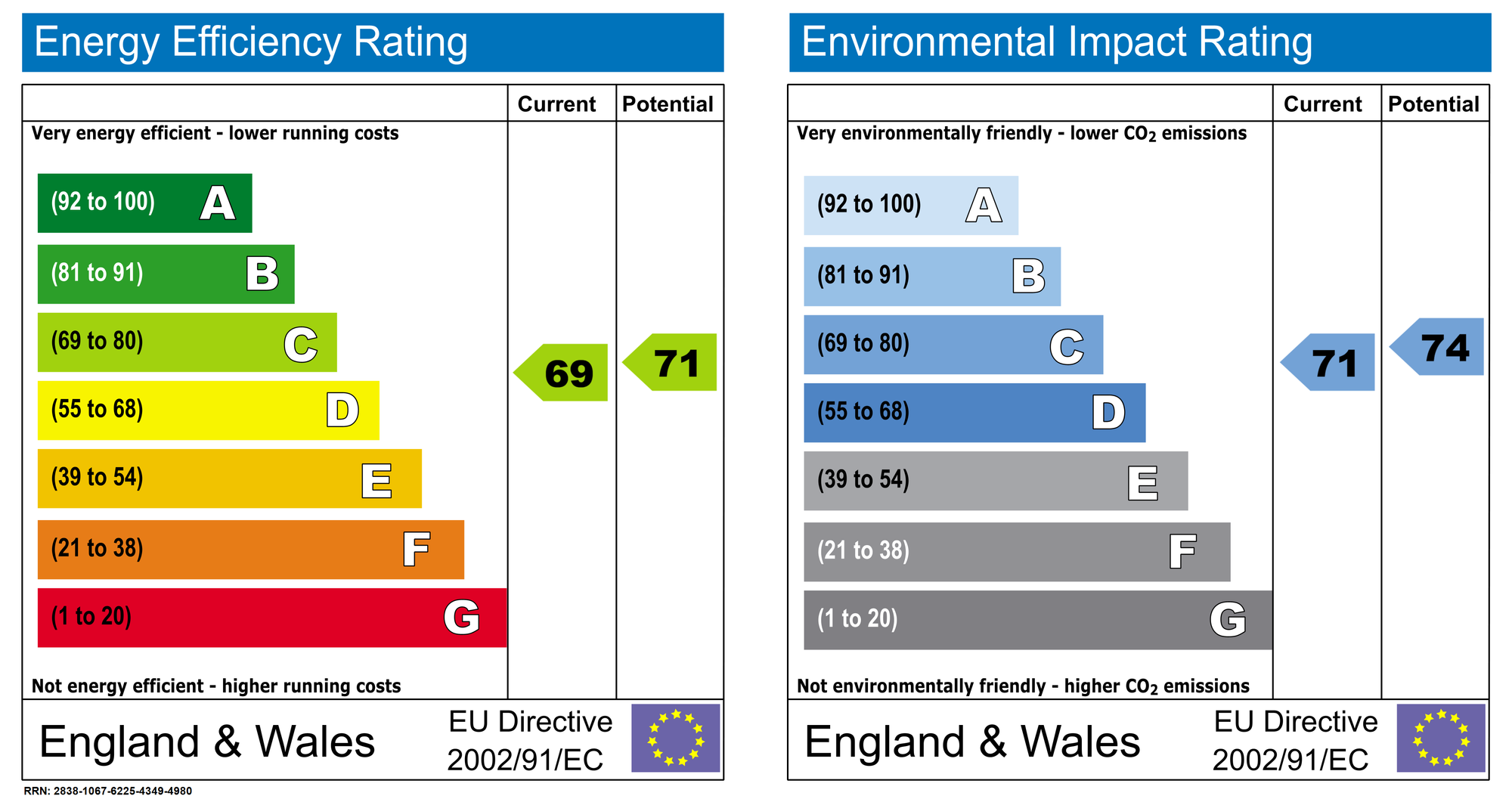

An Energy Performance Certificate (EPC) measures how energy-efficient a home is. Properties are rated from A (most efficient) to G (least efficient), based on factors like insulation, heating systems, and carbon emissions.

Why does it matter?

- Lower bills: More efficient homes are cheaper to run.

- Property value: Buyers are increasingly looking at EPC ratings as part of the decision-making process.

- Mortgage eligibility: Lenders are starting to link products, lower rates, and incentives to EPC performance.

This shift reflects a bigger picture: with the UK aiming for net zero carbon emissions by 2050, EPCs have become a tool for tracking and improving the housing sector’s environmental footprint.

As Lloyds Banking Group puts it:

“To meet the UK government’s targets of net zero by 2050, we must improve the quality of our housing – and urgently.”

— Homes Director, Lloyds Banking Group

The Benefits of Improving Your EPC

Improving your EPC rating is more than just ticking a compliance box. It can bring real financial and environmental benefits.

- Lower energy bills: A better-insulated, more efficient home uses less energy.

- Higher property value: Buyers are increasingly willing to pay more for energy-efficient homes, knowing their running costs will be lower.

- Mortgage incentives: Some lenders are now offering green products and rewards linked to EPC improvements.

Some of the leading UK mortgage lenders like Halifax and Lloyds Bank are highlighting this connection between EPC upgrades and financial support:

“Qualifying mortgage customers could receive up to £2,000 cashback for energy-saving home improvements—such as insulation, solar panels, or a heat pump—and we can even help with installation.”

— Lloyds Bank Eco Home Reward page

That cashback covers improvements like loft insulation, double glazing, solar panels, and even air source heat pumps. And it doesn’t just help with upfront costs, the scheme also offers a free EPC assessment once the work is done, so homeowners can see the impact.

EPCs and the UK’s Net Zero Goals

The UK has committed to becoming carbon neutral by 2050, but residential properties remain a major challenge, accounting for around 16% of the country’s total carbon emissions.

Despite this, the state of energy efficiency across the UK remains concerning. According to recent data, more than half of homes in England and Wales have an EPC rating below band C, the government’s minimum target for all homes by 2035. This means the majority of properties are still falling short of acceptable energy standards which is a major barrier to both sustainability and affordability.

EPCs are critical tools because they provide a consistent and transparent way to measure and improve energy performance. For homeowners and landlords, they highlight current efficiency levels and the upgrades needed to cut bills and emissions. For buyers and policymakers, they create a trusted framework to track progress across the housing market.

This is also why lenders are increasingly tying mortgage products and incentives to EPC performance. By linking financial rewards or eligibility to energy efficiency, banks can support households directly while also driving wider improvements across the housing stock. In doing so, EPC-linked lending connects everyday financial decisions with the UK’s broader climate commitments.

Landlords and the Rental Market

For landlords, EPC ratings are becoming impossible to ignore. Regulations have been tightening for years, and although some proposals have been delayed, the direction of travel is clear: at some point, minimum EPC standards will be required in order to rent out a property.

That means energy efficiency upgrades aren’t just a “nice to have” anymore, they’re fast becoming a core part of managing a successful buy-to-let portfolio.

And the benefits go beyond compliance. Better-rated homes attract better tenants, more efficient properties can reduce running costs, and keeping on top of EPC standards protects the long-term value of your asset.

The rental market is shifting, and greener housing is right at the centre of that change. For landlords, the choice is simple: adapt early and reap the rewards, or risk being left behind as both regulation and tenant demand raise the bar.

Challenges and Criticisms of EPCs

EPC ratings aren’t without their critics. Some argue they can be inaccurate or too simplistic, focusing too heavily on theoretical models rather than real-world energy use. Others point out that they don’t always account for lifestyle factors, meaning two identical homes can perform very differently depending on how people live in them.

But despite their flaws, EPCs remain the most widely used and recognised benchmark for assessing and improving home efficiency. They are the standard tool used by buyers, landlords, lenders, and regulators alike and with government and financial institutions aligning around them, their influence is only set to grow.

For homeowners and landlords, this makes one thing clear: ignoring your EPC rating is no longer an option. If you’re unsure of your property’s rating, you can Check your property’s EPC rating on the official government register to see where your home currently stands and what improvements could make the biggest difference.

Practical Steps: How to Improve Your EPC

If you’re wondering how to take action, the good news is that improving your EPC rating doesn’t always require huge structural changes. Many upgrades are straightforward and can deliver both immediate and long-term benefits. Common improvements include:

- Insulation: Loft, cavity wall, solid wall, or even underfloor insulation can significantly cut heat loss.

- Efficient heating systems: Upgrading to a modern boiler, installing a heat pump, or using smart heating controls makes a big difference.

- Windows: Switching to A-rated double or triple glazing helps retain heat and improve comfort.

- Renewable energy: Solar panels, solar thermal systems, or even battery storage can boost your EPC rating and lower bills.

- Lighting: Replacing older bulbs with LEDs is a low-cost, high-impact win.

These aren’t just upgrades - they can reduce energy bills, increase property value, and future-proof your home against tightening regulations. And once improvements are made, you can get a new EPC assessment to reflect the changes and showcase the results.

Looking Ahead: EPCs as a Market Driver

Over the next decade, EPC ratings are set to become a powerful force in the property market. They are already influencing:

- Mortgage pricing: Green mortgages and financial products offering better rates for efficient homes.

- Property values: Buyers are increasingly aware of running costs and are likely to favour homes with higher ratings.

- Rental compliance: Landlords will need to meet higher EPC standards to keep properties legally lettable.

- Climate reporting: Banks and institutions are tracking EPC-linked data as part of their net zero commitments.

Put simply, EPCs are no longer just a box to tick. They are evolving into a financial, regulatory, and environmental driver which will shape how homes are bought, sold, rented, and financed in the years to come.

The Bottom Line

EPC ratings are no longer just a piece of paper you need when selling a house, they’re fast becoming a cornerstone of the UK housing market. From shaping property values to influencing mortgage products and driving the UK’s Path To Net Zero, EPCs sit at the heart of the transition to greener living.

For homeowners, EPC upgrades mean lower bills, warmer homes, and in some cases, financial rewards through schemes like cashback for energy-saving improvements. For landlords, they are essential for compliance and protecting long-term asset value in an increasingly regulated rental market. And for lenders EPCs offer a clear way to align lending with a more sustainable future.

The message is clear: EPC ratings matter - for your wallet, your property, and the planet.